Some Known Details About San Diego Home Insurance

Some Known Details About San Diego Home Insurance

Blog Article

Keep Prepared for the Unexpected With Flexible Home Insurance Policy Options

In a world where unpredictabilities can emerge at any kind of moment, having a strong foundation of protection for your home is vital. Versatile home insurance choices provide a tactical strategy to guarding your most significant investment. The ability to customize insurance coverage to your specific needs and circumstances gives a complacency that is both reassuring and practical. By exploring the advantages of versatile policies and understanding just how they can help you browse unpredicted circumstances easily, you can genuinely optimize the defense your home deserves. Stay tuned to discover the essential methods for guaranteeing your home insurance aligns flawlessly with your evolving needs.

Importance of Flexibility in Home Insurance

Versatility in home insurance is crucial for suiting diverse needs and ensuring detailed coverage. Property owners' insurance coverage needs differ widely based on elements such as residential property type, area, and personal circumstances. Customizing insurance plan to private needs can supply comfort and monetary security in the face of unforeseen occasions.

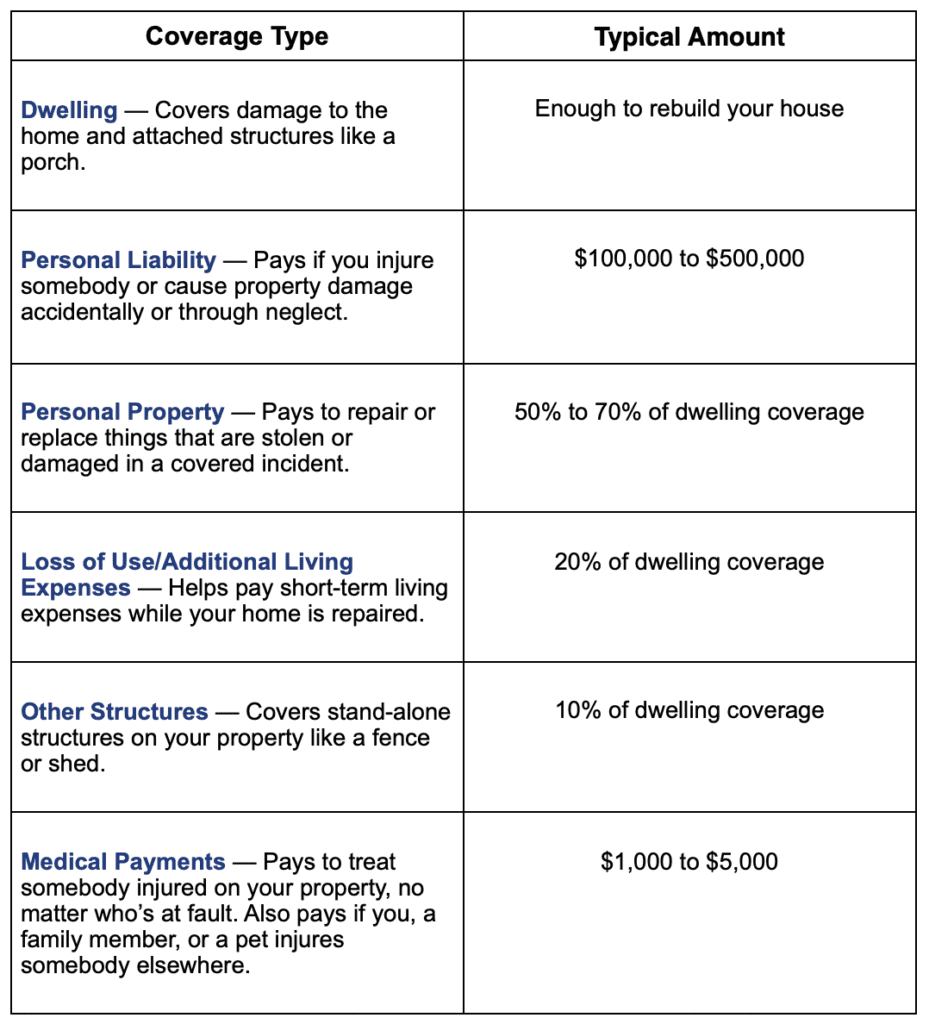

One key facet of versatile home insurance is the capacity to customize insurance coverage restrictions. By changing protection degrees for dwelling, individual property, obligation, and additional living expenditures, property owners can guarantee they are appropriately safeguarded without paying too much for unneeded coverage. House owners in risky locations might pick to boost protection for all-natural disasters, while those with valuable personal valuables might choose for higher personal property limits.

Furthermore, flexibility in home insurance coverage extends to plan alternatives and recommendations. Policyholders can select from a variety of add-ons such as flooding insurance coverage, identity burglary security, or equipment break down coverage to improve their protection. By providing a variety of options, insurance firms encourage home owners to construct a comprehensive insurance coverage bundle that lines up with their distinct needs and choices.

Tailoring Coverage to Your Needs

Customizing your home insurance policy coverage to fulfill your details needs is important for making sure sufficient defense and peace of mind. When it involves choosing the right protection options, it's crucial to take into consideration aspects such as the value of your home, its place, contents, and any type of extra threats you may encounter. By personalizing your plan, you can make sure that you are sufficiently protected in situation of numerous circumstances, such as natural calamities, theft, or obligation cases.

One method to customize your coverage is by picking between various kinds of policies, such as fundamental, wide, or unique kind policies, depending upon your specific requirements. Furthermore, you can go with attachments like flooding insurance coverage, quake coverage, or arranged personal effects endorsements to fill up any type of gaps in your common plan.

On a regular basis reviewing and upgrading your coverage is also crucial, specifically when significant life changes occur, such as procurements, improvements, or additions. San Diego Home Insurance. By staying aggressive and adjusting your policy as needed, you can maintain detailed security that straightens with your progressing demands and circumstances

Advantages of Adaptable Plans

When considering the customization of your home insurance policy protection click resources to match your particular demands, it becomes noticeable that versatile policies use an array of useful benefits. Whether you need to enhance protection due to restorations or decrease protection since your kids have moved out, versatile plans allow for these changes without significant disturbances.

Additionally, versatile plans commonly offer options for additional insurance coverage for details things or threats that may not be included in standard policies. Additionally, versatile policies typically use more control over costs and deductibles, allowing you to discover an equilibrium that functions ideal for your budget while still offering appropriate defense for your home and items.

Handling Unforeseen Situations Effortlessly

In browsing unanticipated scenarios effortlessly, versatile home insurance policy policies supply a safety net that can be adjusted to fulfill changing needs (San Diego Home Insurance). When unforeseen events such as natural catastrophes, thefts, or accidents occur, having a flexible insurance policy can considerably reduce the monetary concern and anxiety connected with these incidents. Versatile plans often allow insurance policy holders to customize insurance coverage limits, add recommendations for details threats, or change deductibles as required, guaranteeing that they are properly protected in numerous circumstances

Several versatile home insurance choices supply additional solutions such as emergency response groups, temporary accommodation insurance coverage, and support for short-lived repair work, allowing insurance holders to navigate difficult conditions with more confidence and comfort. By deciding for versatile home insurance strategies, individuals can better prepare themselves for unforeseen events and manage them with higher convenience and durability.

Making The Most Of Defense Via Customization

To boost the level of safeguarding for property owners, personalizing home insurance protection based on specific demands and circumstances proves to visit their website be a critical approach. By customizing insurance coverage to certain demands, homeowners can maximize protection versus possible threats that are most appropriate to their scenario. Customization permits an extra exact positioning between the insurance coverage used and the actual requirements of the house owner, making sure that they are properly secured in case of unforeseen events.

Through customization, homeowners can readjust protection deductibles, attachments, and limitations to develop a plan that supplies comprehensive protection without unneeded costs. For instance, property owners in locations susceptible to particular all-natural catastrophes can choose added protection that deals with these threats particularly. In addition, important personal belongings such as precious jewelry or art collections can be insured independently to guarantee their full security.

Conclusion

In final thought, flexibility in home insurance coverage allows for customized coverage that can adapt to unforeseen circumstances. By picking adaptable plans, homeowners can guarantee they have the coverage they require when they require it most.

By changing insurance coverage levels for residence, personal residential property, obligation, and added living expenses, property owners can guarantee they are effectively shielded without overpaying for unneeded insurance coverage.Tailoring your home insurance coverage to fulfill your particular you can try these out requirements is essential for making sure adequate protection and peace of mind.When thinking about the modification of your home insurance coverage to match your particular needs, it comes to be evident that adaptable policies use an array of important advantages. Whether you require to raise coverage due to restorations or decrease protection due to the fact that your children have moved out, adaptable policies enable for these changes without significant disturbances.Moreover, adaptable plans often offer choices for extra protection for certain items or risks that may not be consisted of in typical plans.

Report this page